Товарищество. Преимущества и недостатки этого вида бизнеса

Скачать 121.99 Kb. Скачать 121.99 Kb.

|

|

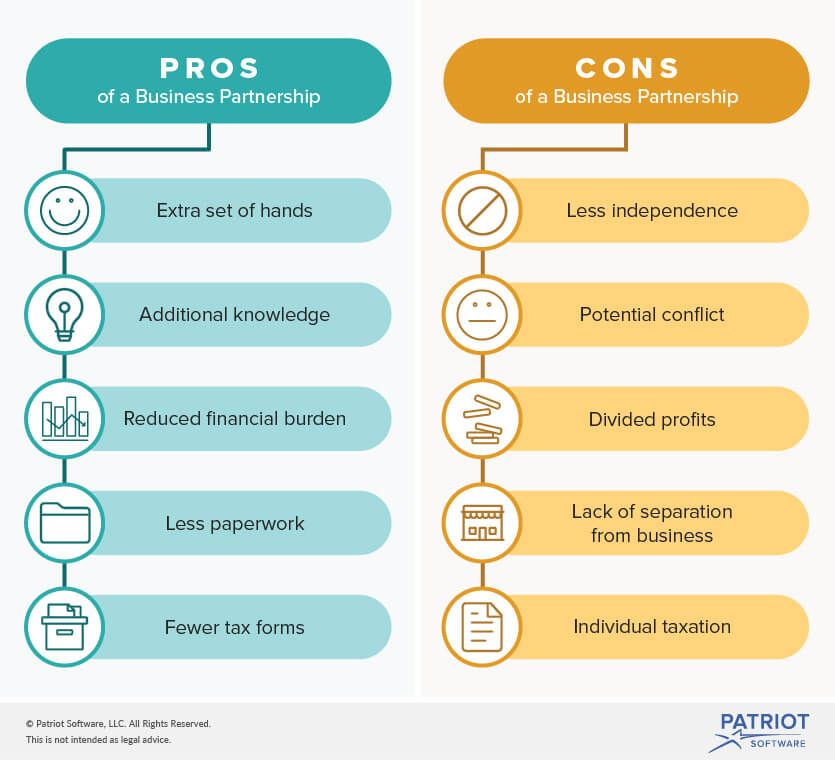

Тема: Товарищество. Преимущества и недостатки этого вида бизнеса. earnings – прибыль, чистый доход (по отношению к предприятию означает чистый доход от какой-л. деятельности: выручка минус затраты); заработок, доход (по отношению к физическому лицу); debt – долг, обязательство; entity – в экономическом смысле: хозяйствующий субъект (физическое или юридическое лицо, занятое экономической деятельностью); юридическое лицо; экономический объект; хозяйственное подразделение; legal being – буквально: юридическое (законное) существо, т.е. субъект права, юридическое или физическое лицо; corporate policies – корпоративные политики, т.е. правила, положения, приказы, инструкции, деловая практика и этические нормы, действующие в корпорации; director – директор, член Совета директоров/Правления; officer – должностное лицо, ответственный сотрудник (обычно в служебной иерархии officer находится выше менеджера, но ниже члена Совета директоров); general public – широкая публика, общественность, неограниченный/неопределенный круг лиц; nonprofit – некоммерческий, не имеющий целью получение прибыли, бесприбыльный; Задание 1. Выполнить письменный перевод текста на русский язык, выписать в тетрадь положительные и отрицательные стороны данной формы собственности. The Pros and Cons of a Partnership  If you’re starting a business and have one or more partners, it might seem obvious to form a business partnership. This is a business structure that allows you and at least one other person to both have ownership of the business. Even though forming a partnership might make sense, it’s not your only option. Before you form a partnership, you must know the pros and cons of this business structure. What are the advantages and disadvantages of a partnership? Pros and cons of a partnership There are three types of partnerships: general partnerships, limited partnerships, and limited liability partnerships. While each type has specific pros and cons, there are partnership pros and cons that cover them all. Before you start choosing a specific partnership type, take a look at general pros and cons of a business partnership.  Pros of a partnership Here are the advantages of having a business partner. You have an extra set of hands Business owners typically wear multiple hats and juggle many tasks. Owners are surrounded by constant busyness, late nights, and smoldering problems. When you have a business partner, you have a person—or multiple people—who can help you with all the business tasks. The partners can divide up tasks, meaning tasks will get done faster and the partners might be able to tackle more than if they worked alone. You benefit from additional knowledge Partners can bring skills and knowledge to your business that you don’t have. You might have a lot of knowledge about the product or service your business provides, but not know how to run a business. You can bring on a partner who is skilled at running a business. Your partner might also have past experiences that can help direct your business onto a successful path. You have less financial burden Starting a business can be expensive. You might have costly overhead expenses for inventory, equipment, retail space, etc. A partner can ease your financial burden. Instead of paying for everything yourself, your partner can split the cost. Because of the partner’s financial contributions, the business might be able to afford more things up front. And, you might be able to avoid large amounts of debt when starting your business. There is less paperwork Starting a partnership isn’t difficult. You don’t have to file special paperwork with the federal government. You probably only have minimal local paperwork. All partners involved must sign a partnership agreement. This agreement will detail the duties and responsibilities of each partner, how decisions will be made, how profits and losses are divided, and more. Creating and signing this document is more simple than filling out the paperwork for other business structures. There are fewer tax forms With partnerships, there are no additional business entity taxes. This means you don’t have to fill out and file business tax forms. Instead, taxes pass through to the business owners. You will include your share of profits and losses on your individual tax return. You are liable for paying any additional taxes. Cons of a partnership Here are the disadvantages of having a business partner. You can’t make decisions on your own You cannot act independently when you’re in a partnership. You must work with your partner to make decisions, or at least run all decisions by your partner. If your partner does act alone and makes a reckless decision, all partners are responsible for the decision and results. The reckless partner cannot be held solely responsible. You’ll have disagreements Anytime you get people together at work, there’s potential for conflict. You and your partners will have disagreements. You might even get sick of working with each other. If this happens, you can’t easily dissolve the partnership. Hopefully, you’ve drawn up a partnership exit strategy. You’ll need to redistribute profits, losses, and responsibilities among any remaining partners. And, you must change your business structure. You have to split profits When you run a business by yourself, you have an opportunity to gain all the profits from the business. But when you have a partnership, you have to share the profits. Depending on how many partners you have, your share of the profits can get fairly small. You aren’t separate from the business A partnership is not a separate legal entity from you and the other partners. All partners are legally and financially responsible for the business. If your business faces legal problems, you won’t be considered separately from your business. And, if your business isn’t able to pay back debts, debt collectors can come after your personal money. You’re taxed individually While being taxed individually is a pro, it’s also a con. Generally, business taxes have lower rates than individual taxes. Because the taxes are passed through to you and your partner(s), you might collectively pay more than if you paid business taxes. |