Ќ Ў®а ⥪бв®ў ⥬㠂’Ћ б ЇҐаҐў®¤®¬ (копия). Всемирная торговая организация

Скачать 0.92 Mb. Скачать 0.92 Mb.

|

|

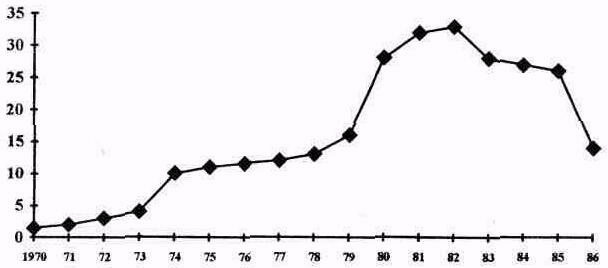

МИНИСТЕРСТВО СЕЛЬСКОГО ХОЗЯЙСТВА РОССИЙСКОЙ ФЕДЕРАЦИИ ФЕДЕРАЛЬНОЕ ГОСУДАРСТВЕННОЕ БЮДЖЕТНОЕ ОБРАЗОВАТЕЛЬНОЕ УЧЕРЕЖДЕНИЕ ВЫСШЕГО ПРОФЕССИОНАЛЬНОГО ОБРАЗОВАНИЯ УРАЛЬСКИЙ ГОСУДАРСТВЕННЫЙ АГРАРНЫЙ УНИВЕРСИТЕТ (ФГБОУ ВПО «УрГАУ») Отдел аспирантуры и докторантуры Кафедра Иностранных языков Подборка статей (400 000 знаков) по дисциплине: Иностранный язык на тему: «Всемирная торговая организация» Аспирант: ____________________ Специальность: 08.00.05 «Экономика и управление народным хозяйством» Проверил: к.п.н., доцент кафедры Иностранных языков _________________________ ____________ 2015 СОДЕРЖАНИЕ What Is Money?Defining Economics The economic environment Competition Taxes The Budget Consumer spending Patterns of foreign trade «Positive» market segmentation Entrepreneurship Factors affecting demand Economic issues Unemployment The Role of Government in the Economy Economic systems U.S. Financial System What is the WTO? Advantages of WTO U.S. Companies Worry About Effect of Russia Joining WTO Life after the WTO Changing the trade rules Sub-committee on least-developed countries Is the WTO a sinking ship? Russia's entry to WTO ends 19 years of negotiations WTO membership only half the battle Russia: WTO accession should lower prices for consumer The Russian Federation Russia's Economy Russia and the future of WTO Russia and WTO. Aims and objectives of accession. Returning to market Agriculture Prices and Consumer Incomes Measuring economic activity Russia's belated entry to WTO will help consumers but subsidized industries will suffer Russia’s economy: Unsustainable support - FT.com WTO forecasts big rise in global trade World Trade Organisation (WTO) No pain, no gain After RF WTO accession duties on imports of confectionery products will be reduced Russia’s parliament ratifies WTO entry Russia’s accession to WTO – ‘a fair deal’? Russia could change food embargo Russia, Ukraine and U.S. Economic Policy Priorities of investment development of the Sverdlovsk region Monopolies The euro crisis ENGLISH ARTICLES What Is Money?Money is a good that acts as a medium of exchange in transactions. Classically it is said that money acts as a unit of account, a store of value, and a medium of exchange. Most authors find that the first two are nonessential properties that follow from the third. In fact, other goods are often better than money at being intertemporal stores of value, since most monies degrade in value over time through inflation or the overthrow of governments. What Is Money? It Is More Than Pieces of Paper.So money isn't just pieces of paper. It's a medium of exchange that facilitates trade. Suppose I have a Wayne Gretzky hockey card that I'd like to exchange for a new pair of shoes. Without the use of money, I have to find a person, or combination of people who have an extra pair of shoes to give up, and just happen to be looking for a Wayne Gretzky hockey card. Quite obviously, this would be quite difficult. This is known as the double coincidence of wants problem: The double coincidence is the situation where the supplier of good A wants good B and the supplier of good B wants good A. The point is that the institution of money gives us a more flexible approach to trade than barter, which has the double coincidence of wants problem. Since money is a recognized medium of exchange, I do not have to find someone who has a pair of new shoes and is looking for a Wayne Gretzky hockey card. I just need to find someone who is looking for a Gretzky card who is willing to pay enough money so I can get a new pair at Footlocker. This is a far easier problem, and thus our lives are a lot easier, and our economy more efficient, with the existance of money. Defining Economics Economics is a science concerned with how people use available resources to satisfy their wants through the process of production and exchange. There have been many definitions of economics in the past. The earliest definitions envisaged economics as the study of wealth and the older name for economics was "political economy". Later economics was defined as "the practical science of the production and distribution of wealth". At the turn of the 19th century economists defined economics as a study of man's actions in the ordinary business of life. At that time economics focused on how men got their incomes and used them. In more recent years, the subject of economics was defined more precisely as "the science which studies how societies use scarce resources to produce valuable commodities and distribute them among different people". Today economics deals with data on income, employment, expenditure, prices, production, consumption, transportation and trade. Economy is a system which tries to balance the available resources of a country, including land, labour, capital and enterprise. The word “economy” derives from Greek language and means “household management”. Economy of a certain region or country is closely interlinked with such areas as culture, education, technological progress, history, political structure, legal systems, natural resources and ecology. These areas or factors set the conditions for the economy. That’s why some cultures create more productive economies and function better than others. As for Russia, its economy strongly depends on its vast natural resources, such as gas, oil, coal and precious metals. The Russian economy is the 8th largest economy in the world. However, it has experienced great changes lately, as it has been affected by global economic crisis. The inflation rate in Russia is quite high and the prices are growing year by year. Unemployment and poverty still remain one of the serious economic problems. In spite of decline, Russia has various profitable branches of industry, for example, metallurgical, automobile, chemical, textile, agricultural, and else. The British economy consists of the economies of England, Scotland, Wales and Northern Ireland. The economy of England is the largest of four countries because England is a highly industrialized country. It is an important producer of textiles and chemical products. The aerospace, defense and pharmaceutical industries play a key role in the development of British economy. There are also many poverty-stricken countries in the world, which are mainly situated in Africa. These countries are known as developing or less-developed countries. The economy in such countries is on a rather low level yet, but they are slowly developing The economic environment The economy comprises millions of people and thousands of firms as well as the government and local authorities, all taking decisions about prices and wages, what to buy, sell, produce, export, import and many other matters. All these organizations and the decisions they take play a prominent part in shaping the business environment in which firms exist and operate. The economy is complicated and difficult to control and predict, but it is certainly important to all businesses. You should be aware that there are times when businesses and individuals have plenty of funds to spend and there are times when they have to cut back on their spending. This can have enormous implications for business as a whole. When the economy is enjoying a boom, firms experience high sales and general prosperity. At such times, unemployment is low and many firms will be investing funds to enable them to produce more. They do this because consumers have plenty of money to spend and firms expect high sales. It naturally follows that the state of the economy is a major factor in the success of firms. However, during periods when people have less to spend many firms face hard times as their sales fall. Thus, the economic environment alters as the economy moves into a recession. At that time, total spending declines as income falls and unemployment rises. Consumers will purchase cheaper items and cut expenditure on luxury items such as televisions and cars. Changes in the state of the economy affect all types of business, though the extent to which they are affected varies. In the recession of the early 1990s the high street banks suffered badly. Profits declined and, in some cases, losses were incurred. This was because fewer people borrowed money from banks, thus denying them the opportunity to earn interest on loans, and a rising proportion of those who did borrow defaulted on repayment. These so-called "bad debts" cut profit margins substantially. Various forecasters reckoned that the National Westminster Bank's losses in the case of Robert Maxwell's collapsing business empire amounted to over £100 million. No individual firm has the ability to control this aspect of its environment. Rather, it is the outcome of the actions of all the groups who make up society as well as being influenced by the actions of foreigners with whom the nation has dealings. Competition All businesses produce goods and services and seek profits. And they all compete with other businesses in doing so. Competition is universal in the world of business. Businesses do not compete only in selling things. They compete for labour, capital, and natural resources. If a business is going to survive in the face of competition, it needs a constant flow of new ideas. It needs managers who are good at developing new products, finding new ways to reduce costs, and thinking of new ways to make products attractive to consumers. In the 1960s Xerox had a virtual monopoly on producing copying machines because the company had major patents. Rivals like Kodak, Canon, and 3M spent huge amounts of money on getting new patents. They succeeded in obtaining new patents, and now Xerox is just one among many competitors in the copier market. Taxes Taxes are a compulsory financial contribution by a person or body of persons towards the expenditure of a public authority. The government has a choice of taxing income, wealth or consumption to finance its expenditure on defence, social services, municipal services etc. The main forms of direct tax are income tax paid by individuals and corporation tax paid by businesses. Income tax in Great Britain dates from the 1790s and has until recently been the major source to generate tax revenue. Income tax can be progressive, proportional or regressive. The idea of a progressive tax is to take more from those who earn more. Indirect taxes are imposed on certain products or services that people buy. The main ones are value added tax and excise duties. Pressure to increase government expenditure may lead to a search of new taxes. Some people argue for a more direct link between specific taxes and particular items of government expenditure. For example, taxes from motorists could be spent on roads and the transport system while the tax from alcohol and tobacco could be spent on the national health service. But it is impossible for the government to match all individual taxes with particular spending programmes. The major principles of a tax system are that it should be equitable and reasonable. Then the incentive to avoid and evade tax would be less. The system of tax collection shouldn't be costly and shouldn't contain a lot of tax allowances and exemptions. The Budget The budget is the government's main economic statement of the year. It is a forecast of revenue and expenditure for the conning year. In Great Britain the budget is prepared and usually issued in March. In a major speech to Parliament, the Chancellor of the Exchequer reviews the nation's economic performance and describes the government's economic objectives and the economic policies it intends to follow in order to achieve them. In November 1993 Great Britain introduced the "so-called" Unified Budget. Under this budget the government presents taxation and spending proposals to Parliament at the same time. The Budget now covers both the government's taxation plans for the coming financial year and its spending plans for the next three years. The proposals are announced to the House of Commons by the Chancellor of the Exchequer in the Budget statement and are published in the Financial Statement and Budget Report. This report also contains a review of recent developments in the economy, together with an economic forecast, and sets out the fiscal and monetary policies. The main sources of revenue are: • Tax on income; • Taxes on expenditure, which include VAT (Value Added Tax) and customs and excise duties; • National Insurance contributions. Consumer spending The modern market economy is populated by three types of economic agents, whose interaction constitutes economic activity: consumers, producers, and the government. The main purpose of the economy is to produce goods and services for the satisfaction of the needs of consumers. Consumers, typically representing households, spend their income to buy consumer goods and services or to save. How does a consumer distribute the income earned by him amongst a variety of goods and services offered in the market? There are different factors affecting his decisions. For instance, a fall in the price of a good or service will increase his consumption of it, while a rise in its price will have the opposite effect. Then a rise in his real income will naturally result in an increased consumption of goods and services, a fall in real income having the opposite effect1. The pattern of consumer expenditure is also influenced by tastes, consumer preferences and family circumstances. As incomes rise, expenditure on basic goods will form a smaller proportion of total spending. The terms "necessities" and "luxuries" are of little use in analyzing consumer expenditure because what are today's luxuries will probably be tomorrow's necessities. It should be stressed here, that some customers, however, want to have high-quality products even when quality means a higher price. Some other customers prefer foreign products. The amount spent on goods and services and changes in this variable have a big impact on the level of economic activity: the increase in consumer spending creates new employment opportunities and causes better living standards. Patterns of foreign trade Currently, foreign firms can participate in the Soviet market in a number of ways. These include direct sales, trade through agents, production cooperation, the signing of licensing agreements, the creation of joint ventures. Direct Sales. The most common means of doing business with the USSR is through straight sales of foreign goods in exchange for foreign currency or Soviet-produced commodities (countertrade). In a countertrade transaction the Seller agrees to take full or partial payment in goods. Countertrade covers barter, counterpurchase, buyback. A barter deal involves an exchange of goods to an equal va¬lue. As a rule, little or no currency is involved. Counterpurchase refers to short and medium-term transactions. The Western Seller commits himself to purchase an agreed value of the Buyer's products to help finance the original sale. The counterpurchase element of a contract may be about 10 percent of the total contract value. Buyback refers to long-term contracts and is connected with the development projects supported with huge credits. Buyback involves two phases, one for the delivery of equipment to the Buyer and a second for the delivery of the end product to the Seller. Foreign Economic Restructuring has affected the conduct of foreign trade, the banking system and the role of the Soviet enterprise in the economy. The main points of the foreign trade reform are: - enterprises now have the right to conduct foreign trade; - industrial enterprises are allowed to maintain hard curency bank accounts; - greater emphasis is made on exports and world marketing technique. - inward investment by means of joint ventures is encouraged; Some plants and factories team up with research centres to form a consortium. Their final objective is to sell the equipment produced in a package deal. One of the most acute problems facing Soviet economy external¬ly and internally is non-convertibility of the rouble which is a se¬rious handicap in relations with its trade counterparts. The Economic reform sets a task to make the rouble conver¬tible. «Positive» market segmentation Market segmenting is dividing the market into groups of individual markets with similar wants or needs that a company divides the market into distinct groups who have distinct needs, wants, behavior or who might want different products & services. Broadly, markets can be divided according to a number of general criteria, such as by industry or public versus private although industrial market segmentation is quite different from consumer market segmentation, both have similar objectives. All of these methods of segmentation are merely proxies for true segments, which don't always fit into convenient demographic boundaries. Consumer-based market segmentation can be performed on a product specific basis, to provide a close match between specific products and individuals. However, a number of generic market segment systems also exist, e.g. the Nielsen Claritas PRIZM system provides a broad segmentation of the population of the United States based on the statistical analysis of household and geo-demographic data. The process of segmentation is distinct from targeting (choosing which segments to address) and positioning (designing an appropriate marketing mix for each segment). The overall intent is to identify groups of similar customers and potential customers; to prioritize the groups to address; to understand their behavior; and to respond with appropriate marketing strategies that satisfy the different preferences of each chosen segment. Revenues are thus improved. Improved segmentation can lead to significantly improved marketing effectiveness. Distinct segments can have different industry structures and thus have higher or lower attractiveness (Michael Porter). With the right segmentation, the right lists can be purchased, advertising results can be improved and customer satisfaction can be increased leading to better reputation. Market segmentation is the act of identifying and profiling distinct groups of buyers who might require separate products and/or marketing mixes. It is the process of splitting customers into different groups or segments, within which customers with similar characteristics have similar needs. Benefits: 1) marketers are in a better position to locate and compare marketing opportunities 2) marketers can easily and effectively formulate and implement marketing programs 3) marketers can make finer adjustments in their products and marketing communications. 4) Competitive strengths and weaknesses can be assessed effectively 5) Segmentation leads to more effective utilisation of marketing resources Entrepreneurship Entrepreneurship is the act of being an entrepreneur, which is a French word meaning "one who undertakes innovations, finance and business acumen in an effort to transform innovations into economic goods". This may result in new organizations or may be part of revitalizing mature organizations in response to a perceived opportunity. The most obvious form of entrepreneurship is that of starting new businesses (referred as Startup Company); however, in recent years, the term has been extended to include social and political forms of entrepreneurial activity. When entrepreneurship is describing activities within a firm or large organization it is referred to as intra-preneurship and may include corporate venturing, when large entities spin-off organizations. According to Paul Reynolds, entrepreneurship scholar and creator of the Global Entrepreneurship Monitor, "by the time they reach their retirement years, half of all working men in the United States probably have a period of self-employment of one or more years; one in four may have engaged in self-employment for six or more years. Participating in a new business creation is a common activity among U.S. workers over their course of their careers." And in recent years has been documented by scholars such as David Audretsch to be a major driver of economic growth in both the United States and Western Europe. Entrepreneurial activities are substantially different depending on the type of organization that is being started. Entrepreneurship ranges in scale from solo projects (even involving the entrepreneur only part-time) to major undertakings creating many job opportunities. Many "high value" entrepreneurial ventures seek venture capital or angel funding (seed money) in order to raise capital to build the business. Angel investors generally seek returns of 20-30% and more extensive involvement in the business. Many kinds of organizations now exist to support would-be entrepreneurs, including specialized government agencies, business incubators, science parks, and some NGOs. In more recent times, the term entrepreneurship has been extended to include elements not related necessarily to business formation activity such as conceptualizations of entrepreneurship as a specific mindset (see also entrepreneurial mindset) resulting in entrepreneurial initiatives e.g. in the form of social entrepreneurship, political entrepreneurship, or knowledge entrepreneurship have emerged. Factors affecting demand Innumerable factors and circumstances could affect a buyer's willingness or ability to buy a good. Some of the more common factors are: - Good's own price: The basic demand relationship is between the price of a good and the quantity supplied. Generally the relationship is negative or inverse meaning that an increase in price will induce a decrease in the quantity demanded. This negative relationship is embodied in the downward slope of the consumer demand curve. The assumption of an inverse relationship is reasonable and intuitive. If the price of a new novel is high, a person might decide to borrow the book from the public library rather than buy it. Or if the price of a new equipment is high a firm may decide to repair existing equipment rather than replacing it. - Price of related goods: The principal related goods are complements and substitutes. A complement is a good that is used with the primary good. Examples include hotdogs and mustard; beer and pretzels, automobiles and gasoline. Close complements behave as a single good. If the price of the complement goes up the quantity demanded of the other good goes down. Mathematically, the variable representing the complementary good would have a negative coefficient. For example, Qd = P - Pg where Q is quantity of automobiles demanded, P is the price of automobiles and Pg is the price of gasoline. The other main category of related goods are substitutes. Substitutes are goods that can be used in place of the primary good. The mathematical relationship between the substitute and the good in question is negative. If the price of the substitute goes down the demand for the good in question goes up, - Income: The more money you have the more likely you are to buy a good. - Taste or preferences: the greater the desire to own a good the more likely you are to buy the good. There is a basic distinction between desire and demand. Desire is a measure of the willingness to buy a good. Demand is the willingness and ability to affect one's desires. It is assumed that tastes and preferences are relatively constant. - Consumer expectations about future prices and income: If a consumer believes that the price of the good will be higher in the future he is more likely to purchase the good now. If the consumer expects that her income will be higher in the future the consumer may buy the good now. In other words positive expectations about future income may encourage present consumption (Demand increases). This list is not exhaustive. All facts and circumstances that a buyer finds relevant to his willingness or ability to buy goods can affect demand. For example, a person caught in an unexpected storm is more likely to buy an umbrella than if the weather were bright and sunny. Economic issues Economics is the study of how people choose to allocate scarce resources to satisfy their unlimited wants. The main problem in economics is the question of allocating scarce resources between competing uses. In this section three economic issues are discussed to show how society allocates its scarce resources between competing uses. In this connection the question what, how and for whom to produce is of great significance. The oil price shocks Oil is an important commodity in modem economies. Oil and its derivatives provide fuel for heating, transport, and machinery, and arc basic inputs for the manufacture of industrial petrochemicals and many household products ranging from plastic utensils to polyester clothing. From the beginning of this century until 1973 the use of oil Increased steadily. Over much of this period the price of oil fell in comparison -with the prices of other products. Economic activity was organized on the assumption of cheap and abundant oil. In 1973 – 74 there was an abrupt change. The main oil-producing nations, mostly located in the Middle East but including also Venezuela and Nigeria, belong to OPEC — the Organisation of Petroleum Exporting Countries. Recognizing that together they produced most of the world's oil, OPEC decided in 1973 to raise the price at which this oil was sold. Although higher prices encourage consumers of oil to try to economize on its use, OPEC countries correctly forecast that cutbacks in the quantity demanded would be small since most other nations were very dependent on oil and had few commodities available as potential substitutes for oil. Thus OPEC countries correctly anticipated that a substantial price increase would lead to only a small reduction in sales. It would be very profitable for OPEC members. Oil prices are traditionally quoted in US dollars per barrel. Fig. 1 shows the price of oil from 1970 to 1986. Between 1973 and 1974 the price of oil tripled, from $2,90 to $9 per barrel. After a more gradual rise between 1974 and 1978 there was another sharp increase between 1978 and 1980, from $12 to $30 per barrel. The dramatic price increases of 1973 – 79 and 1980 – 82 have become known as the OPEC oil price shocks, not only because they took the rest of the world by surprise but also because of the upheaval they inflicted on the world economy, which had previously been organized on the assumption of cheap oil prices. People usually respond to prices in this or that way. When the price of some commodity increases, consumers will try to use less of it but producers will want to sell more of it. These responses, guided by prices, are part of the process by which most Western societies determine what, how and for whom to produce.Consider first how the economy produces goods and services. When, as in the 1970s, the price of oil increases six-fold, every firm will try to reduce its use of oil-based products. Chemical firms will develop artificial substitutes for petroleum inputs to their production processes; airlines will look for more fuel-efficient aircraft; electricity will be produced from more coal-fired generators. In general, higher oil prices make the economy produce in a way that uses less oil. Sions Oil price ($ per barrel)  Figure 1. The price of oil. 1970 – 86 How does the oil price increase affect what is being produced? Finns and households reduce their use of oil-intensive products, which are now more expensive. Households switch to gas-fired central heating and buy smaller cars. Commuters form car-pools or move closer to the city. High prices not only choke off the demand for oil-related commodities; they also encourage consumers to purchase substitute commodities. Higher demand for these commodities bids up their price and encourages their production. Designers produce smaller cars, architects contemplate solar energy, and research laboratories develop alternatives to petroleum in chemical production. Throughout the economy, what is being produced reflects a shift away from expensive oil-using products towards less oil-intensive substitutes. The for whom question in this example has a clear answer. OPEC revenues from oil sales increased from $35 billion in 1973 to nearly $300 billion in 1980. Much of this increased revenue was spent on goods produced in the industrialized Western nations. In contrast, oil-importing nations had to give up more of their own production in exchange for the oil imports that they required. In terms of goods as a whole, the rise in oil prices raised the buying power of OPEC and reduced the buying power of oil-importing countries such as Germany and Japan. The world economy was producing more for OPEC and less for Germany and Japan. Although it is the most important single answer to the 'for whom' question, the economy is an intricate, interconnected system and a disturbance anywhere ripples throughout the entire economy, In answering the 'what' and 'how' questions, we have seen that some activities expanded and others contracted following the oil price shocks. Expanding industries may have to pay higher wages to attract the extra labour that they require. For example, in the British economy coal miners were able to use the renewed demand for coal to secure large wage Increases. The opposite effects may have been expected if the 1986 oil price slump had persisted. The OPEC oil price shocks example illustrates how society allocates scarce resources between competing uses. A scarce resource is one for which the demand at a zero price would exceed the available supply. We can think of oil as having become more scarce in economic terms when its price rose. Unemployment One of the greatest factors in our economy today is unemployment. Unemployment is the labor force participants that have inability to find jobs. There are certain exceptions to being unemployed such as woman who devotes her time to being a housewife or a person who is doing charity work and donating their time. An important rule of thumb before discussing how unemployment affects our economy is to remember that, to get the maximum out of the available production capacity we need to reach full employment. Before I get started on discussing how unemployment effects our economy I would like to show some interesting statistics. According to the Government 6.5 million people are unemployed, 5.5% of people are unemployed, and 12% of people are below the poverty line. But according to the infamous Michael Moore up to 13 million people are unemployed, up to 11% of people are unemployed and 20 % of people are below the poverty line. As you can see, the United States Government has totally different numbers than Michael Moore. This is because the government can not account for everyone in their country. People without homes can not be counted as homeless because there is no way to contact all of them, or not count them twice. The types of unemployment are cyclical that is related to the business cycle, falling GDP growth, and workers who are laid off due to falling demand for labor. Iit is caused also by declining aggregate demand. Then there is structural that is a mismatch of labor skills with the offered job vacancies. It is cause by economic reforms and new technologies such as the car industry and by workplace downsizing and tariff or quota cuts. Frictional is another type of unemployment and is from people moving jobs or looking for their first job or rejoining the work force, this is just normal labor market turnover. Seasonal unemployment is self explanatory; examples would be Christmas jobs or fruit pickers. Arthur Okun measured the relationship of the production possibilities curve and unemployment. Okun’s law can be stated as saying that for every one percentage point by which the actual unemployment rate exceeds the «natural» rate of unemployment, there is a 2 to 4 % «GDP Gap». That is, unemployment above the inflation-threshold unemployment rate corresponds to real gross domestic product below potential output. When a country is facing unemployment problems there are certain opportunity costs for it’s citizens, which means the economy is not running on full production frontier. These opportunity costs are lower living standards, consume resources, no production contribution. A decline in labor market skills for the long term unemployed and finally lower wage growth. One of the reasons so many people are unemployed is DOWNSIZING. Downsizing is laying off a lot of people all at the same time. It is mostly done to increase company profits. For example AT&T laid off 40,000 people and made $16 million and IBM laid off 60,000 people and made $2.6 million. During the late 1990′s, many large companies started downsizing, but then the news caught hold of it and it made headlines all around the United States. The cover of Newsweek had mug shots of CEO’s with the title «Corporate Criminals». Many large companies soon realized that they had to lay off people in smaller amounts. But I have a list of many of the companies that laid off people under the radar: NEC, Oshkosh, AOL, Westinghouse, Honeywell, RJR Nabisco, Hewlett-Packard, US West, Wells Fargo, Kmart, Office Depot, Honeywell, Whirlpool, Lockheed Martin, First Boston, TRW, Goodyear, Samsonite, Sunbeam, Raytheon, McDonnell Douglas, WM. Wrigley Jr. Co., and many many more. I would like to now go into more effects of Unemployment economically and socially. First off higher unemployment causes lower real GDP, reduced national income and lower living standards. Economic and social hardships are suffered by families of the unemployed. There is also a social stigma attached to unemployment. The longer a person is unemployed the harder will be for them to ever set foot in the productive world again. The increase in the taxation burden as taxpayers must fund the social security payments. It can also lead to a less equal distribution of income. Other social costs include the rising crime rates, family breakdowns, loss of dignity, drug use and alcoholism. The Role of Government in the Economy In every economy the work of different firms has to be coordinated. In a market economy this coordination is achieved by means of markets. Nevertheless the debate over the role for Government in a market economy is continuing and the issue is being widely discussed at the present time. An economy based on free enterprise is generally characterized by private ownership and initiative, with a relative absence of government involvement. However, government intervention has been found necessary from time to time to ensure that economic opportunities are fair, to dampen inflation and to stimulate growth. Government plays a big role in the American free enterprise system. Federal, state and local governments tax, regulate, and support business. In the United States there are agencies to regulate safety, health, environment, transport, communications, trade, labour relations, and finances. Regulation ensures that business serves the best interests of the people as a whole. Some industries — nuclear power, for instance — have been regulated more closely over the last few years than ever before. In others the trend has been towards deregulation or reduction of administrative burden on the economy. The U.S. economy has a tradition of government intervention for specific economic purposes — including controlling inflation, limiting monopoly, protecting the consumer, providing for the poor. The government also affects the economy by controlling the money supply and the use of credit. The aim is a balanced budget. Economic systems There are a number of ways in which a government can organize its econ-omy and the type of system chosen is critical in shaping environment in which businesses operate. An economic system is quite simply the way in which a country uses its available resources (land, workers, natural resources, machinery etc.) to satisfy the demands of its inhabitants for goods and services. The more goods and services that can be produced from these limited resources, the higher the stan-dard of living enjoyed by the country's citizens. There are three main economic systems: Planned economics Planned economies are sometimes called "command economies" because the state commands the use of resources (such as labour and factories) that are used to produce goods and services as it owns factories, land and natural re-sources. Planned economies are economies with a large amount of central planning and direction, when the government takes all the decisions, the gov-ernment decides production and consumption. Planning of this kind is obviously very difficult, very complicated to do, and the result is that there is no society, which is completely a command economy. The actual system employed varies from state to state, but command or planned economies have a number of common features. Firstly, the state decides precisely what the nation is to produce. It usually plans five years ahead. It is the intention of the planners that there should be enough goods and services for all. Secondly, industries are asked to comply -with these plans and each industry and factory is set a production target to meet. If each factory and farm meets its target, then the state will meet its targets as set out in the five-year plans. You could think of the factory and farm targets to be objectives which, if met, allow the nation's overall aim to be reached. A planned economy is simple to understand but not simple to operate. It does, however, have a number of advantages: • Everyone in society receives enough goods and services to enjoy a basic standard of living. • Nations do not waste resources duplicating production. • The state can use its control of the economy to divert resources to wherever it wants. As a result, it can ensure that everyone receives a good education, proper health care or that transport is available. Several disadvantages also exist. It is these disadvantages that have led to many nations abandoning planned economies over recent years: • There is no incentive for individuals to work hard in planned economies. • Any profits that are made are paid to the government. • Citizens cannot start their own businesses and so new ideas rarely come for-ward. • As a result, industries in planned economies can be very inefficient. A major problem faced by command or planned economies is that of deciding what to produce. Command economies tend to be slow when responding to changes in people's tastes and fashions. Planners are likely to underproduce some items as they cannot predict changes in demand. Equally, some products, which consumers regard as obsolete and unattractive, may be overproduced. Planners are afraid to produce goods and services unless they are sure substantial amounts will be purchased. This leads to delays and queues for some products. Market economics The best examples of this type of economy are to be found in small South-East Asian states like Hong Kong and Singapore, though even they are not pure examples of market economies. Even they contain some businesses owned and run by the state. In a true market economy the government plays no role in the management of the economy, the government does not intervene in it. The system is based on private enterprise with private ownership of the means of production and private supplies of capital, which can be defined as surplus income available for investment in new business activities. Workers are paid wages by employers according to how skilled they are and how many firms wish to employ them. They spend their wages on the products and services they need. Consumers are willing to spend more on products and services, which are favoured. Firms producing these goods will make more profits and this will persuade more firms to produce these particular goods rather than less favoured ones. Thus, we can see that in a market economy it is consumers who decide what is to be produced. Consumers will be willing to pay high prices for products they particularly desire. Firms, which are privately owned, see the opportunity of increased profits and produce the new fashionable and favoured products. Such a system is, at first view, very attractive. The economy adjusts auto matically to meet changing demands. No planners have to be employed, which allows more resources to be available for production. Firms tend to be highly competitive in such an environment. New advanced products and low prices are good ways to increase sales and profits. Since all firms are privately owned they try to make the largest profits possible. In a free market individual people are free to pursue their own interests. They can become millionaires, for example. Suppose you invent a new tend of car. You want to make money out of it in your own interests. But when you have that car produced, you are in fact moving the production possibility frontier outwards. You actually make the society better off by creating new jobs and opportunities, even though you become a millionaire in the process, and you do it without any government help or intervention. Not surprisingly there are also problems. Some goods would be underpurchased if the government did not provide free or subsidised supplies. Examples of this type of good and service are health and education. There are other goods and services, such as defence and policing, that are impossible to supply individually in response to consumer spending. Once defence or a police force is supplied to a country then everyone in this country benefits. A cornerstone of the market system is that production alters swiftly to meet changing demands. These swift changes can, however, have serious consequences. Imagine a firm, which switches from labour-intensive production to one where new technology is employed in the factory. The resulting unemployment could lead to social as well as economic problems. In a market economy there might be minimal control on working conditions and safety standards concerning products and services. It is necessary to have large-scale government intervention to pass laws to protect consumers and workers. Some firms produce goods and then advertise heavily to gain sufficient sales. Besides wasting resources on advertising, firms may also duplicate one another's services. Rival firms, providing rail services, for example, could mean that two or more systems of rail are laid. Finally, firms have to have confidence in future sales if they are to produce new goods and services. At certain times they tend to lack confidence and cut back on production and the development of new ideas. This decision, when taken by many firms, can lead to a recession. A recession means less spending, fewer jobs and a decline in the prosperity of the nation. Mixed economics Command and market economies both have significant faults. Partly because of this, an intermediate system has developed, known as mixed economies. A mixed economy means very much what it says as it contains elements of both market and planned economies. At one extreme we have a command economy, which does not allow individuals to make economic decisions, at the other extreme we have a free market, where individuals exercise considerable economic freedom of choice without any government restrictions. Between these two extremes lies a mixed economy. In mixed economies some resources are controlled by the government whilst others are used in response to the demands of consumers. Technically, all the economies of the world are mixed: it is just the balance elements between market and planned elements that alters. Some countries are nearer to command economies, while others are closer to free market economies. So, for example, Hong Kong has some state-controlled industry, while Cuba has some privately owned and controlled firms. The aim of mixed economies is to avoid the disadvantages of both systems while enjoying the benefits that they both offer. So, in a mixed economy the government and the private sector interact in solving economic problems. The state controls the share of the output through taxation and transfer payments and intervenes to supply essential items such as health, education and defence, while private firms produce cars, furniture, electrical items and similar, less essential products. The UK is a mixed economy: some services arc provided by the state (for example, health care and defence) whilst a range of privately owned businesses offer other goods and services. The Conservative government under Margaret Thatcher switched many businesses from being state-owned and controlled to being privately owned as part of its privatization programme. This has taken the UK economy further away from the planned system. U.S. Financial System Corporations have the need to raise capital for a number of reasons. Smaller firms need capital to start up operations. Larger firms need capital to expand operations and to finance inventory. There are various ways in which a firm can raise capital through the financial system and numerous individuals and entities that can assist a corporation in this crucial venture. Start-up firms and small businesses petition investors for what is known as venture capital. Venture capital comes from wealthy investors, usually a group, who see the potential for growth in smaller businesses. In the early 1990’s the Securities and Exchange Commission (SEC) expanded its role to assist small businesses. The SEC made it easier for small businesses to raise capital through public stock offerings. Corporations also raise money to finance debt. Businesses sell bonds to investors in order to raise money for working capital and capital expenditures. The corporation agrees to pay back the principal plus interest, therefore making the investors creditors. Bond holders are able to sell bonds to others before they are due. Selling bonds are beneficial to corporations because, in addition to raising capital, bonds also have much lower interest rates that are tax deductible. The down side is that corporations must make interest payments regardless of whether they turn a profit. This often is not an option for smaller businesses. Larger corporations that exist as public companies can also sell bonds in order to raise capital. Public companies can issue preferred stock along with common stock. Preferred stock is a higher-ranking stock than common stock and preferred stock holders have a greater claim to a company’s assets and earnings. Holders of preferred stock may also have dividends paid before holders of common stock and these dividends are paid at regular intervals, whereas common stock dividends are only paid out when a board of director’s decides to make a payout. Preferred stock often has no voting rights, however, as opposed to common stock. Preferred stock is usually offered to investors, where as common stock is usually offered to employees. Another means of raising both short and long-term capital is through international markets. According to authors Stanley Block and Geoffrey Hirt (2005), “When the markets are good, money is cheap and easy to find, and when the markets are bad, money is hard to find and relatively expensive. The world economic markets often move back and forth between the two extremes”. Short-term markets, or money markets, consist of securities that will mature in a year or less. Money markets provide short-term funding for the global financing system. Treasury bills and commercial paper are bought and sold in money markets. Corporations may also use more traditional methods for raising capital by borrowing from banks and other established lenders. Businesses that require financing for inventory often borrow from banks. Firms can use retained earning, or profits, to raise capital. Depending on the size of the corporation some or all of a company’s profits may be held back for further investment before issuing dividends. Corporations often look to investment bankers to handle many of these functions. Investment bankers typically have a solid background in finance and economics and are specialists in financial analysis. These bankers act as intermediaries, or middle men, between corporations looking to raise capital and investors. Investment bankers oversee the issuing of bonds, manage selling a company’s stock and advise corporations on acquiring and merging with other companies. What is the WTO? The WTO was born out of negotiations, and everything the WTO does is the result of negotiations. The bulk of the WTO’s current work comes from the 1986–94 negotiations called the Uruguay Round and earlier negotiations under the General Agreement on Tariffs and Trade (GATT). The WTO is currently the host to new negotiations, under the ‘Doha Development Agenda’ launched in 2001. Where countries have faced trade barriers and wanted them lowered, the negotiations have helped to open markets for trade. But the WTO is not just about opening markets, and in some circumstances its rules support maintaining trade barriers — for example, to protect consumers or prevent the spread of disease. At its heart are the WTO agreements, negotiated and signed by the bulk of the world’s trading nations. These documents provide the legal ground rules for international commerce. They are essentially contracts, binding governments to keep their trade policies within agreed limits. Although negotiated and signed by governments, the goal is to help producers of goods and services, exporters, and importers conduct their business, while allowing governments to meet social and environmental objectives. The system’s overriding purpose is to help trade flow as freely as possible — so long as there are no undesirable side effects — because this is important for economic development and well-being. That partly means removing obstacles. It also means ensuring that individuals, companies and governments know what the trade rules are around the world, and giving them the confidence that there will be no sudden changes of policy. In other words, the rules have to be ‘transparent’ and predictable. Trade relations often involve conflicting interests. Agreements, including those painstakingly negotiated in the WTO system, often need interpreting. The most harmonious way to settle these differences is through some neutral procedure based on an agreed legal foundation. That is the purpose behind the dispute settlement process written into the WTO agreements. |